Table of Content

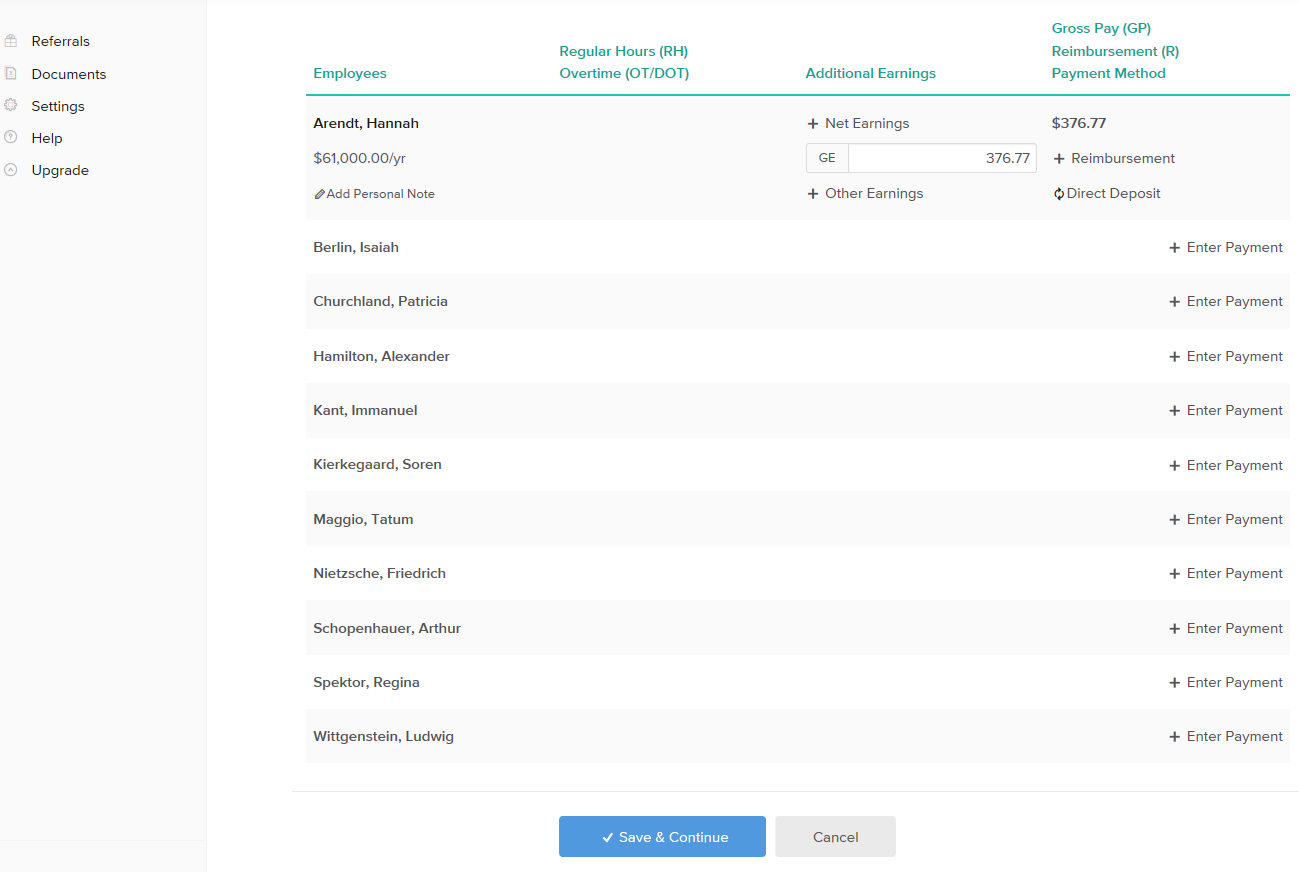

An easy, time-saving payroll solution for your small business. While it might sound good to get a large return, remember that if you had access to that money throughout the year, you could have put it toward something else, like a down payment or your retirement savings. By overpaying the IRS all year, you’re essentially giving them an interest-free loan. If you’re a new employer (congratulations on getting started!), you pay a flat rate of 3.1% (this is including a 0.3% stabilization tax). Hourly individuals must enter their hourly rate and number of straight time, time and 1/2 and double time hours. The IRS has changed the withholding rules effective January 2020.

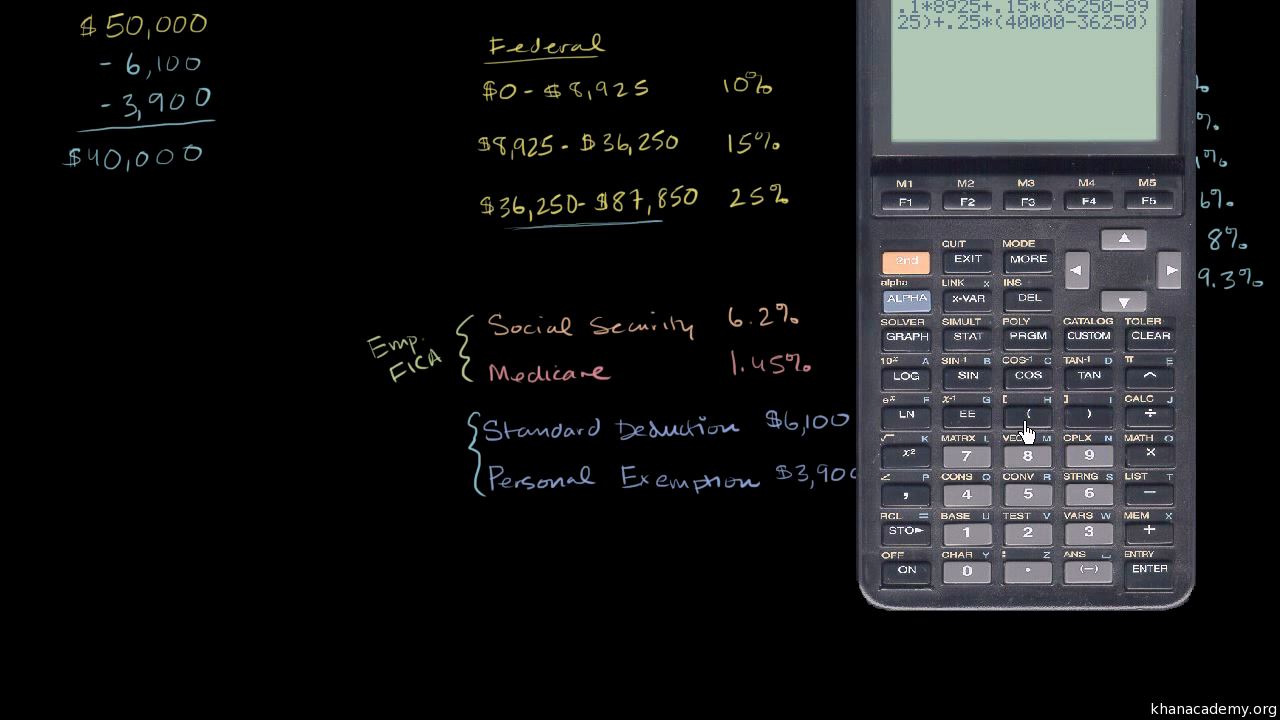

6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 ($160,200 for 2023). So any income you earn above that cap doesn’t have Social Security taxes withheld from it. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. Your FICA taxes are your contribution to the Social Security and Medicare programs that you’ll have access to when you’re a senior.

Arkansas Gross-Up Calculator

- We regularly check for any updates to the latest tax rates and regulations. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your company’s health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

On the first $10,000 in wages paid to each employee in a calendar year. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Your location will determine whether you owe local and / or state taxes. In general, it is wise to stop contributing towards retirement when facing immediate financial difficulty. However, depending on the severity of the financial situation, a case could be made for at least contributing as much as possible towards what an employer will match for a 401. Figures entered into "Your Annual Income " should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount .

Arkansas Income Tax Brackets and Other Information

Exemptions can be claimed for each taxpayer as well as dependents such as one’s spouse or children. Arkansas taxpayers pay some of the highest sales tax rates in the country, while also having some of the lowest property tax rates. Please keep in mind that these calculators are designed to provide general guidance and estimations. They are not official advice and do not represent any Netchex service. Please consult an accountant or invest in full-servicepayroll softwareto guarantee quick, automatic, and accurate payroll and tax services.

You can also update your W-4 if your filing status changes or if you have additional non-wage income that isn't subject to withholding. When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It's important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn't. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions.

Self-service payroll for your small business.

Arkansas residents have to pay taxes just like all U.S. residents. For federal income taxes and FICA taxes, employers withhold these from each of your paychecks. That money goes to the IRS, who then puts it toward your annual income taxes, Medicare and Social Security. The information on your W-4 is what your employer uses to figure out how much to withhold for federal taxes. That’s why you need to fill out a W-4 whenever you start a new job.

Please stay on topic and remember to be kind to each other. If you would like to report a bug or issue with one of our pages or calculators, please direct message us on twitter instead. In 2022, due to recent tax bracket changes, there is also another widely available tax credit in the form of a bracket adjustment credit for those earning between $84,500 and $90,600. Cotton was the main cash crop in the early years of Arkansas' economy along with a budding industry of lumberjacks. Cotton and lumber are still important, but not as important as they used to be. In the present time, Arkansas' manufacturing income is more than its agricultural income, but the state's basic wealth is still tied up in farms, forests, and mines.

Does Arkansas collect personal income tax?

Within this law, the IRS also made revisions to the Form W-4. The new W-4 also uses a five-step process that allows filers to enter personal information, claim dependents and indicate any additional income or jobs. Each of these updates primarily affect anyone who is starting a new job or adjusting their withholdings. Your employer figures out how much to withhold in taxes from each of your paychecks from the information you put in your W-4 form. For example, how many qualifying dependents you have and your filing status (single, head of household, etc.) affect your income tax bracket. The new W-4 no longer utilizes allowances, as it now requires you to input annual dollar amounts for things like non-wage income, income tax credits, itemized and other deductions and total annual taxable wages.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but you’re more likely to get a tax refund and less likely to have tax liability when you fill out your tax return. One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven't had enough withheld to cover your tax liability for the year.

This means when an employee’s income reaches $200,000 in a calendar year, the employer should withhold 2.35% for Medicare, and it’s called the Additional Medicare Tax. The Social Security and Medicare taxes are collectively known as FICA . Each year, the state of Arkansas publishes new Tax Tables for the new tax year, the Arkansas Tax Tables are published by the Arkansas State Government. This year, you expect to receive a refund of all federal income tax withheld because you expect to have zero tax liability again. If you think you qualify for this exemption, you can indicate this on your W-4 Form. Federal income tax rates range from 10% up to a top marginal rate of 37%.

The total taxes deducted for a single filer are $737.94 monthly or $340.59 bi-weekly. Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Not a Kansas taxpayer yet, but considering a move to the Sunflower State? Check out our Kansas mortgage guide to get important info on what it’s like to get a mortgage in Kansas. The Salary Calculator will then produce your salary after tax calculation.

No comments:

Post a Comment